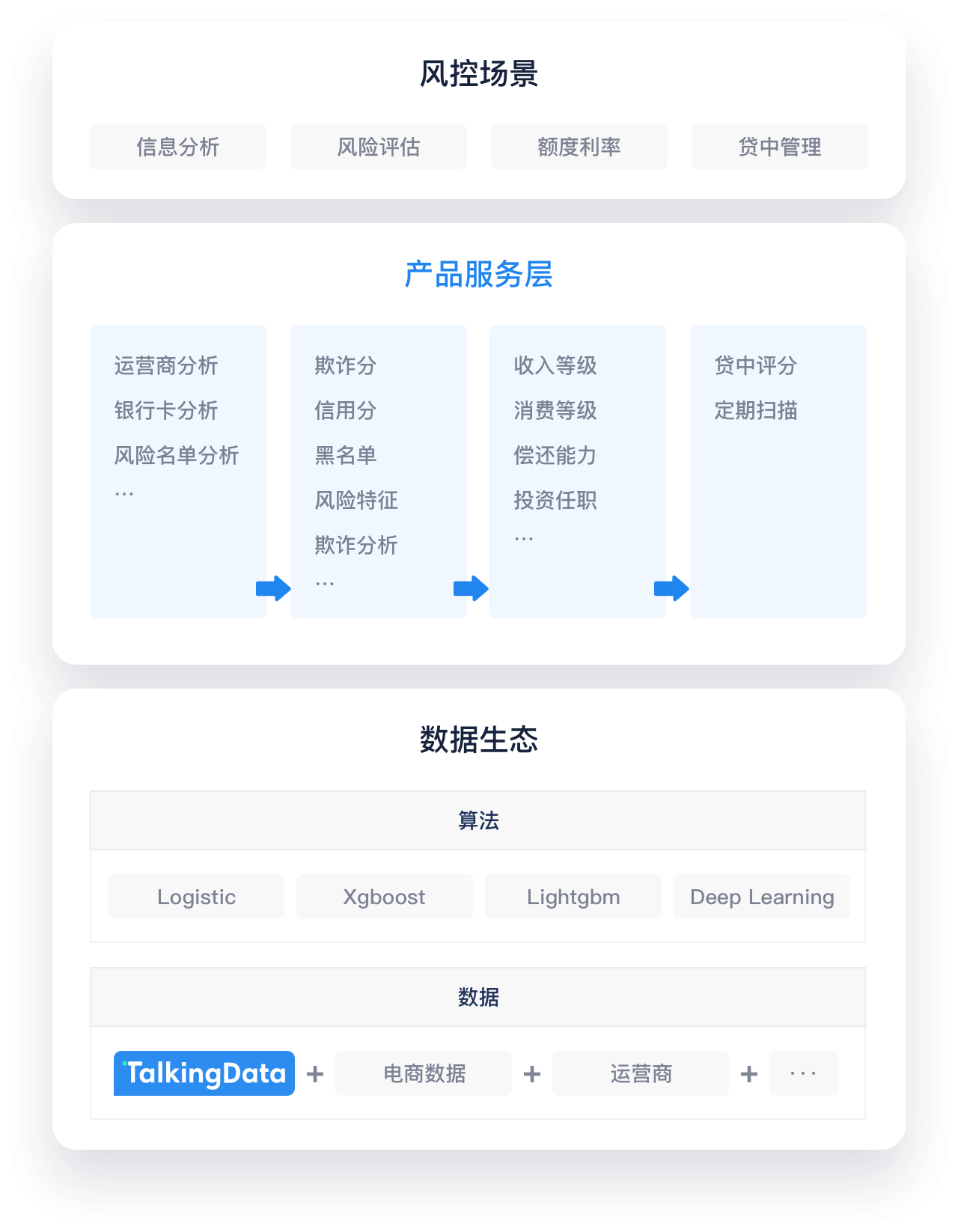

Intelligent Risk Control

We create an overall risk control solution relying on TalkingData's massive compliance policy ecosystem and big data risk control technology, and combining the multi-dimensional data of partner institutions. We provide risk control supplementary solutions such as information analysis, fraud risk identification, customer risk assessment, quota and interest rate assessment, and real-time monitoring during lending.

Core Advantages

A wide range of risk control products, catered for different risk control business scenarios

Massive and rich data ecosystem, safe, compliant and stable

Our remarkale products help form strong and solid partnerships with many financial institutions